SUSREG 2023 REPORT RESULTS: ENVIRONMENTAL AND SOCIAL INTEGRATION OF FINANCIAL REGULATION IS GROWING, BUT CLIMATE AND BIODIVERSITY RISK MANAGEMENT NEEDS STRENGTHENING

Jakarta, 20 December 2023 - WWF International has released the Sustainable Financial Regulation and Central Bank Activities -or better known as SUSREG- tracker 2023 Report on Monday, December 18, 2023.

The results show an improvement, with some central banks and financial authorities in the observed countries having made progress in implementing "greener" financial regulation and supervision compared to the 2021 SUSREG report. However, significant gaps remain, particularly in high-income, high greenhouse gas emitting and biodiversity-rich countries.

This year's report included 47 jurisdictions representing more than 88% of global Gross Domestic Product (GDP), 72% of total greenhouse gas (GHG) emissions, and 11 of the 17 most biodiverse countries.

Furthermore, the results of this report mention that 18% of central banks have successfully adopted and considered the risks of climate change impacts in their monetary policies and bank activities. Meanwhile, 68% of high-income countries have not adopted banking supervision policies that prioritize climate and environmental risks. Similarly, there is an unequal ambition and implementation of sustainable finance policies among countries.

The impact of climate change cannot be separated from the loss of biodiversity and ecosystem services, Dewi Rizki, Conservation Director of WWF-Indonesia said, "We are currently faced with the impact of multiple crises, namely the climate and natural crises. Overcoming this double crisis requires all breakthroughs, one of which is the role of financial regulators which is very crucial. These financial regulators play an important role in producing regulations so that the policy instruments developed are very strong so that they can support the achievement of climate change targets and also the Kunming-Montreal Global Biodiversity Framework."

The SUSREG 2023 report also revealed that some of the highest emitting countries have not implemented strong banking and insurance supervision policies related to climate change. In addition, in terms of the net-zero target, 20 of the 37 countries observed still have very weak climate-based banking supervision policies.

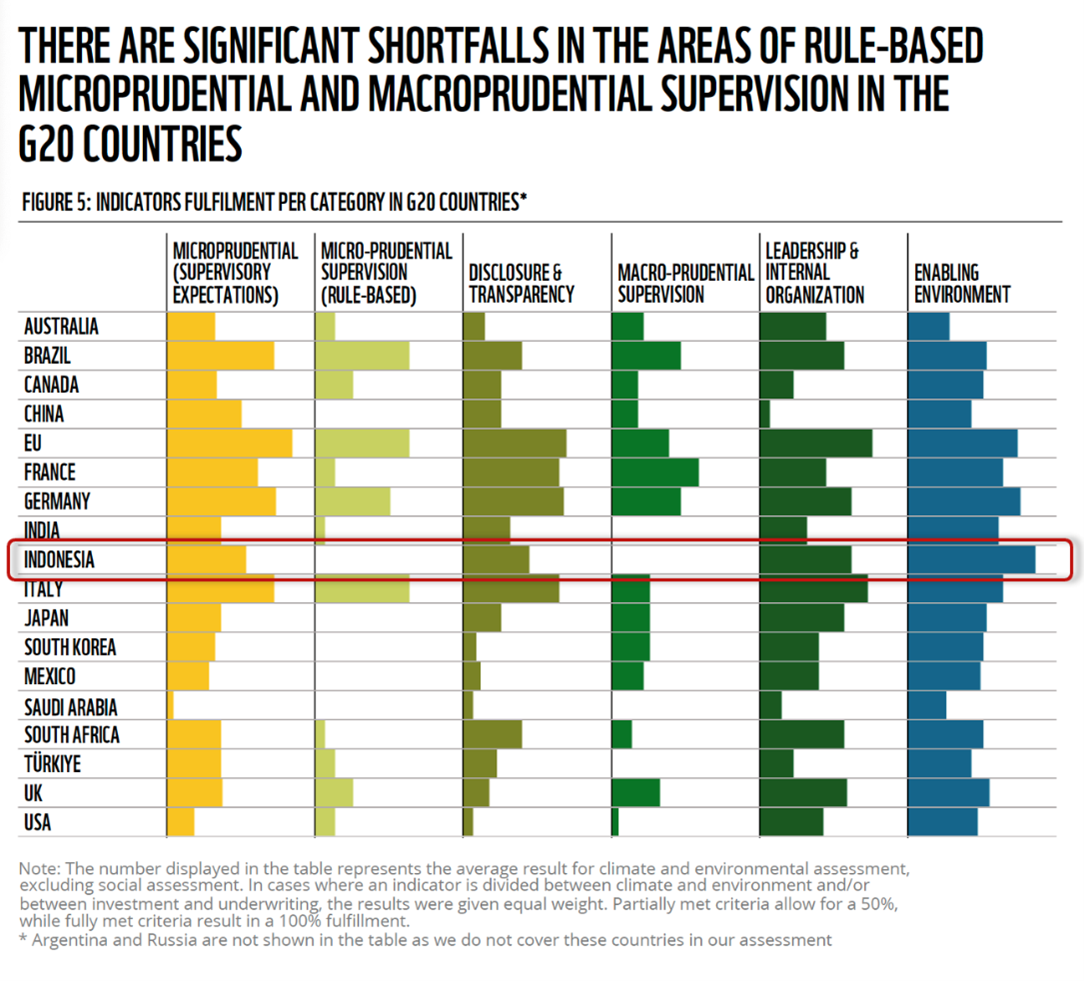

On the overall SUSREG 2023 banking supervision indicators, Indonesia showed progress in four of the six categories, specifically in the categories of microprudential (supervisory expectations), leadership & internal organization, disclosure & transparency and enabling environment. However, the report shows that there is still a status quo in the categories of micro-prudential supervision (rule-based) and macro-prudential supervision.

Based on the SUSREG 2023 assessment results chart above, Indonesia has surpassed the G-20 countries in achieving fulfillment on the enabling environment indicator. Various efforts contribute to this indicator, such as financial regulations issued by the Government of Indonesia, the Financial Services Authority and Bank Indonesia.

Some of the supporting regulations are first, Presidential Regulation No. 98 of 2021 concerning the implementation of Carbon Emission Value (NEK). Second, the provision of easing the Loan to Value (LTV) Ratio for Property Loans, Financing to Value (FTV) Ratio for Property Financing, and Down Payment for Motor Vehicle Loans or Financing through Bank Indonesia Regulation (PBI) No. 23/2/PBI/2021. Third, the provision of incentives by OJK for banks to encourage credit to the battery-based electric motor vehicle (KBLBB) industry. Fourth, Member of the Board of Governors Regulation (PADG) No. 1 of 2023 concerning the Second Amendment to PADG No. 24/4/PADG/2022 concerning Implementation Regulations for Incentives for Banks Providing Funds for Certain and Inclusive Economic Activities and PADG No. 11 of 2023 concerning Implementation Regulations for Macroprudential Liquidity Incentive Policies (PADG KLM), both of which aim to encourage the growth of bank credit and financing to environmentally sound sectors.

In addition to strengthening the enabling environment indicator, the two PADGs also contribute to the development of the integration of climate and environmental risks, precisely on the SUSREG banking indicator.

Another highlighted achievement for Indonesia is its support in making a positive impact on nature, in support of the development of the "blue economy". In this regard, the Government of Indonesia issued the world's first blue bond in May 2023, which was offered in the Japanese bond market, and raised US$150 million.

"Through this report, we identified room for strengthening, including Indonesia's role in integrating broader environmental risks, such as nature conservation, into its banking supervision," said Rizkia Sari Yudawinata, Sustainable Finance Lead, WWF-Indonesia. "Therefore, of all the recommendations outlined in this report, WWF-Indonesia emphasizes the urgency for central banks and financial authorities to immediately start conducting scenario analysis and stress tests for financial services institutions, not limited to climate risks, but also biodiversity. This includes exploring the development of appropriate policy instruments to provide targeted and timely navigation." Add Rizkia.

It is known that Indonesia is one of the richest countries and highly dependent on ecosystem services and biodiversity, to fulfill its GDP growth. This dependency indicates the urgency to proactively anticipate the negative impacts that ecosystem disruptions may have on the economy, especially on the financial system.

Finished

For media related inquiries, contact to:

Karina Lestiarsi, Communication Officer

klestiarsi@wwf.id / +62 852 181 616 83

The full report, along with research results, conclusions, recommendations based on SUSREG tracker assessment can be downloaded at the link here and the Executive Summary can be accessed at the link here..

About SUSREG WWF Tracker Assessment

In 2021, WWF launched for the first time the Sustainable Financial Regulations and Central Bank Activities (SUSREG) assessment to evaluate the social and environmental risks integrated with regulatory and supervisory practices such as central bank and other financial activities. The objective of the assessment is to help central banks and financial supervisors benchmark their policies against regional and global policy guidance in order to direct financial system flows towards sustainable systems, and reduce lending to, and underwriting and investment from, the most environmentally harmful businesses and sectors, in support of a net zero and positive economy. The countries assessed are mainly members and observers of the Basel Committee on Banking Supervision (BCBS), the International Association of Insurance Supervisors (IAIS), and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). The assessment is published annually with an annual report. This year's assessment indicators have been expanded to cover issues such as the gradual transition of central bank change plans, water-related risks, availability of SME guidelines, and sustainable government bond issuance. The assessment was expanded from 44 countries in 2022 to 47 countries in 2023. Individual country assessment results are available on the SUSREG Tracker here online platform. With an initial focus on banking supervision, the SUSREG framework will be gradually expanded over the years to cover other important parts of the financial system such as capital markets and asset management.

More information: https://www.susreg.org/.

About WWF's Greening Financial Regulation Initiative (GFRI)

WWF's Greening Financial Regulation Initiative seeks to put climate and environmental risks at the core of the financial system. Through this initiative, WWF wants to prove the link between financial risks and environmental risks such as climate change, water scarcity, and biodiversity decline, and engage policymakers, such as central banks, and financial supervisors on the need to integrate such risks into their mandates and operations. In doing this, WWF provides the tools, scientific research, assessments and assistance needed to help advance the ambitions of the global sustainable finance policy agenda.

More information: www.panda.org/gfr .

About WWF Indonesia Foundation

The WWF Indonesia Foundation is an Indonesian incorporated civil society organization engaged in nature conservation and sustainable development, with the support of more than 100,000 supporters. WWF Indonesia Foundation's mission is to halt environmental degradation and build a future where people live in harmony with nature, through the conservation of the world's biodiversity, the sustainable use of renewable natural resources, and support for the reduction of pollution and overconsumption.

For the latest news, visit www.wwf.id and follow us on Twitter @WWF_id | Instagram @wwf_id | Facebook WWF-Indonesia | Youtube WWF-Indonesia.